When it comes to managing money wisely, a rules-based approach can provide structure and guidance for making sound financial decisions. In the realm of money management, there are various strategies and techniques that individuals can employ to enhance their financial well-being. One such approach is rules-based money management, which involves establishing specific rules and guidelines to govern investment decisions.

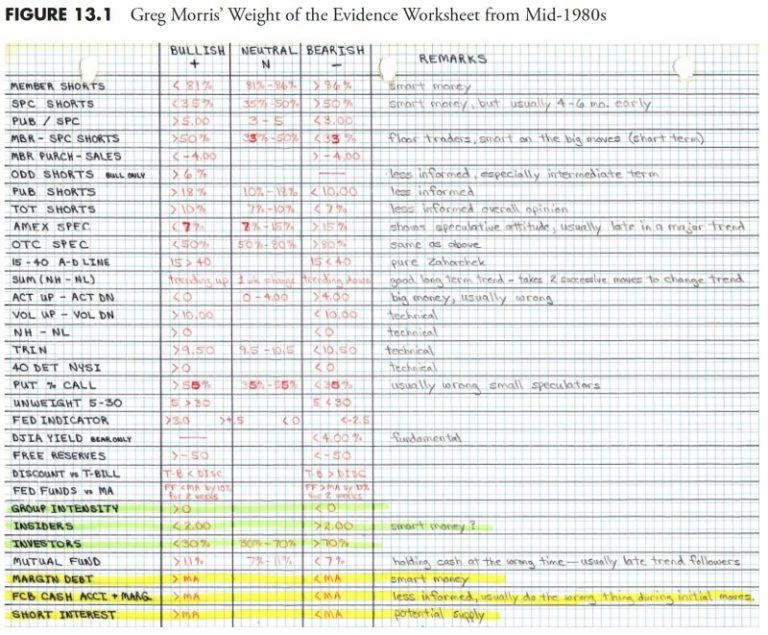

Measuring the market is a crucial aspect of rules-based money management. By evaluating and analyzing market trends and performance, investors can make informed decisions that align with their financial goals. Measuring the market involves using various metrics and indicators to assess the overall health and direction of the market. This information can help investors determine the optimal times to buy, sell, or hold their investments.

One key metric used in measuring the market is market breadth. Market breadth refers to the overall performance of the market, taking into account the number of stocks that are advancing versus declining. A healthy market breadth indicates a broad-based rally, with a larger number of stocks participating in the upward trend. Conversely, a narrow market breadth suggests that only a few stocks are driving the market higher, which may not be sustainable in the long run.

Another essential tool for measuring the market is technical analysis. Technical analysis involves evaluating past market data, such as price movements and trading volume, to identify trends and patterns that can help predict future price movements. Technical analysis can provide valuable insights into market behavior and can help investors make more informed decisions about when to enter or exit positions.

In addition to market breadth and technical analysis, investors can also use various economic indicators to measure the market. Economic indicators, such as gross domestic product (GDP) growth, employment figures, and inflation rates, provide valuable information about the overall health of the economy. By monitoring these indicators, investors can gain a better understanding of the macroeconomic factors influencing the market and adjust their investment strategies accordingly.

Ultimately, measuring the market is a critical component of rules-based money management. By leveraging tools such as market breadth, technical analysis, and economic indicators, investors can enhance their decision-making process and improve their overall investment outcomes. By staying informed and diligent in monitoring market trends, investors can position themselves for success and achieve their financial goals.