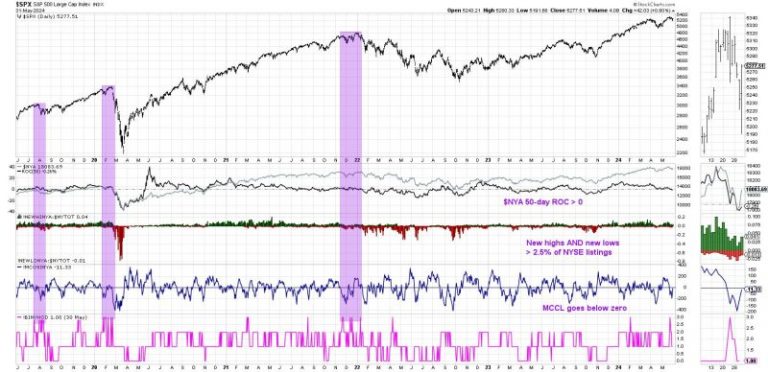

The recent occurrence of the Hindenburg Omen flashing an initial sell signal has sparked concerns and discussions within the financial community. The Hindenburg Omen is a technical analysis pattern that is used in an attempt to predict potential stock market crashes. While it is named after the infamous Hindenburg disaster of 1937, it is important to note that the omen is not foolproof and should be viewed as one of many indicators rather than a definitive signal of impending doom.

Understanding the Hindenburg Omen requires a grasp of technical analysis and market dynamics. The omen is triggered when a series of specific market conditions align simultaneously. These conditions include a rising number of new highs and new lows in the market, as well as high market volatility. When these criteria are met, an initial sell signal is generated, indicating a potential weakening of market internals.

Proponents of the Hindenburg Omen argue that it has been a reliable indicator of past market downturns. However, critics point out that the omen has also produced false signals in the past, leading to unnecessary panic and selling. Like all market indicators, the Hindenburg Omen should be used in conjunction with other analyses and not as a standalone tool for making investment decisions.

In the current economic environment, with uncertainties surrounding global economies, geopolitical tensions, and inflationary pressures, investors are understandably on edge. The flashing of the Hindenburg Omen’s initial sell signal has added to the prevailing sense of unease in the market. It is crucial for investors to maintain a balanced perspective and not make impulsive decisions based solely on one indicator.

As always, diversification, risk management, and a long-term investment horizon remain fundamental principles for navigating volatile market conditions. While the Hindenburg Omen may serve as a cautionary sign, it is essential for investors to conduct thorough research, seek professional advice, and remain disciplined in their investment approach.

In conclusion, the Hindenburg Omen flashing an initial sell signal has captured the attention of investors and analysts alike. While this indicator warrants consideration, it is not a definitive predictor of market crashes. Investors should approach the omen with caution, conduct thorough analysis, and make investment decisions based on a comprehensive and well-rounded strategy. By maintaining a disciplined and informed approach, investors can navigate market uncertainties and strive for long-term financial success.