Sector Rotation Model Flashes Warning Signals

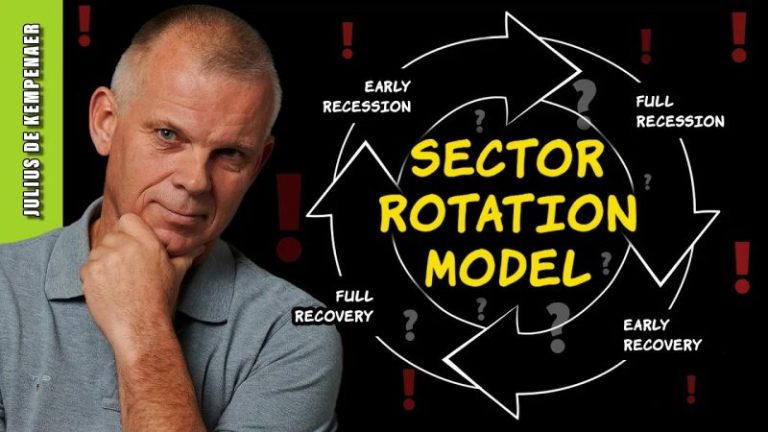

In the world of investing, understanding sector rotation is crucial for making informed decisions. Sector rotation refers to the phenomenon where money flows in and out of different sectors of the economy based on prevailing economic conditions. A sector rotation model is a tool that helps investors analyze these movements and identify potential shifts in market sentiment. Recently, the sector rotation model has been flashing warning signals, indicating potential areas of concern for investors.

The sector rotation model assesses the relative strength of various sectors by comparing their performance against a benchmark index, such as the S&P 500. By analyzing this data, investors can gain insights into which sectors are gaining momentum and which are losing steam. This information is valuable for devising investment strategies and allocating assets accordingly.

One of the key warning signals from the sector rotation model is the underperformance of certain sectors that are traditionally seen as defensive or recession-resistant. Defensive sectors, such as utilities and consumer staples, tend to outperform during economic downturns due to their stable revenues and relatively low volatility. However, if these sectors start underperforming, it could indicate a shift in market sentiment towards riskier assets.

Another warning signal from the sector rotation model is the outperformance of certain sectors that are typically associated with economic growth and expansion. Sectors such as technology, industrials, and consumer discretionary are considered cyclical and tend to do well during periods of economic growth. If these sectors are outperforming the broader market, it may suggest that investors are more optimistic about the economy’s prospects.

Additionally, the sector rotation model can also highlight potential opportunities for investors to capitalize on emerging trends. By monitoring sector rotations, investors can identify sectors that are showing strength and may offer attractive investment opportunities. For example, the rise of renewable energy and electric vehicles has led to increased interest in the energy and industrial sectors, presenting opportunities for investors to profit from these trends.

It is essential for investors to pay close attention to warning signals from the sector rotation model and adjust their investment strategies accordingly. By staying informed about sector rotations and market trends, investors can make more informed decisions and position themselves for success in an ever-changing market environment. As with any investment strategy, thorough research and due diligence are key to navigating the complexities of the market and achieving long-term financial goals.