Market sentiment indicators are crucial tools for investors and traders to gauge the mood and behavior of market participants. By analyzing these indicators, market participants can make more informed decisions about the potential direction of the market. In the current market environment, three key market sentiment indicators have confirmed a bearish phase, indicating a shift towards a more negative sentiment among investors.

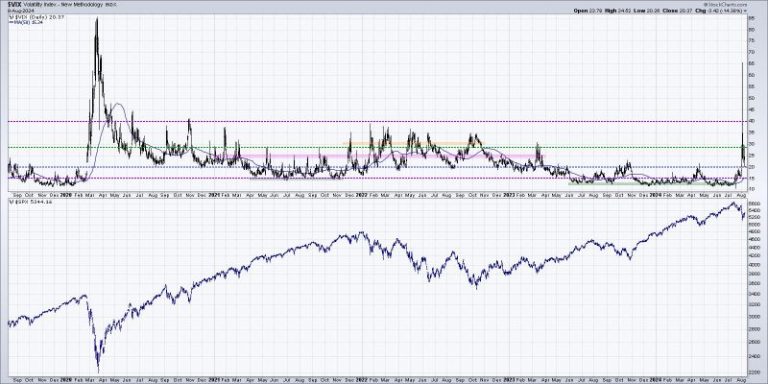

The first market sentiment indicator confirming the bearish phase is the CBOE Volatility Index (VIX), also known as the fear index. The VIX measures market expectations for volatility over the next 30 days and is often used as a barometer of investor sentiment. A rising VIX suggests that investors are becoming more nervous and expect higher price fluctuations in the market. In recent weeks, the VIX has seen a notable uptrend, signaling increased fear and uncertainty among market participants. This heightened volatility can lead to erratic market movements and potential downturns in stock prices.

The second market sentiment indicator supporting the bearish phase is the Investor Intelligence Bull-Bear Ratio. This ratio compares the number of bullish investors to bearish investors and provides insight into overall market sentiment. A high ratio indicates a high level of bullishness, suggesting that investors are optimistic about the market’s prospects. Conversely, a low ratio indicates heightened bearish sentiment, signaling a more pessimistic outlook. In the current market environment, the Bull-Bear Ratio has been trending lower, indicating a shift towards a more bearish sentiment among investors. This shift in sentiment could potentially lead to selling pressure and downward trends in the market.

Another significant market sentiment indicator confirming the bearish phase is the Put/Call Ratio. This ratio compares the number of put options (bearish bets) to call options (bullish bets) traded on the market. A high Put/Call Ratio suggests that investors are buying more put options, indicating a more negative sentiment and a higher expectation of market declines. Conversely, a low Put/Call Ratio suggests a more optimistic sentiment with a bias towards market appreciation. In recent weeks, the Put/Call Ratio has been on the rise, indicating an increasing preference for put options and a growing bearish sentiment among investors. This shift towards bearish bets could potentially foreshadow downward pressure on the market.

In conclusion, market sentiment indicators play a vital role in helping investors navigate the complexities of the financial markets. The three market sentiment indicators discussed – the VIX, Investor Intelligence Bull-Bear Ratio, and Put/Call Ratio – have all confirmed a bearish phase, reflecting a more pessimistic sentiment among market participants. As investors monitor these indicators and stay attuned to market sentiment, they can better position themselves to make informed decisions in response to changing market dynamics. By keeping a close watch on these indicators and understanding the implications of bearish sentiment, investors can adapt their strategies and portfolios accordingly to navigate uncertain market conditions.