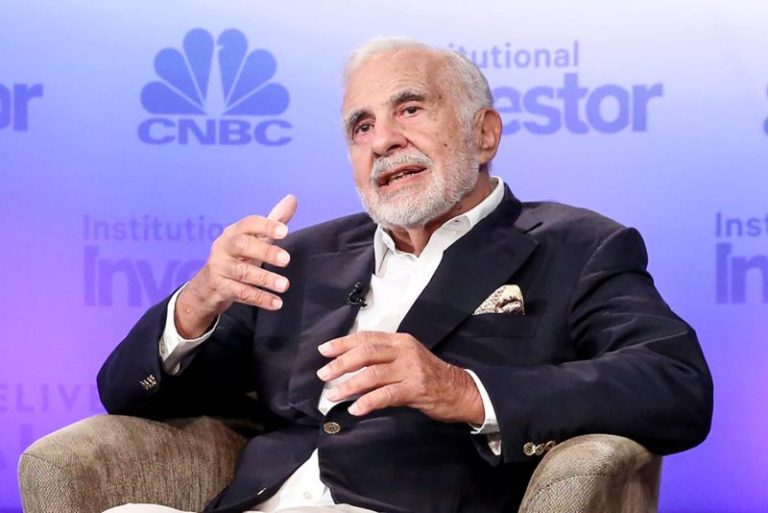

The Securities and Exchange Commission (SEC) has charged billionaire investor Carl Icahn with allegedly failing to disclose approximately $1.7 billion worth of stock pledges during his high-profile trading activities. This significant development highlights the meticulous scrutiny that regulators employ to ensure transparency and integrity in the financial markets.

Icahn, known for his activist investing and corporate raiding, has maintained a prominent position in the financial world for decades. His investment strategies and market-moving decisions often attract widespread attention and influence market sentiments. However, the recent allegations by the SEC shed light on potential lapses in regulatory compliance that have raised concerns among investors and stakeholders.

The heart of the matter lies in the requirement for investors with significant ownership stakes to disclose their positions and activities transparently to the public and regulatory bodies. By pledging shares as loan collateral, investors like Icahn may expose themselves to heightened risks and conflicts of interest that could impact market dynamics and investor confidence.

The SEC’s enforcement action underscores the critical role of regulatory oversight in safeguarding the integrity of financial markets and protecting investor interests. Transparency and accountability are fundamental principles that underpin the functioning of capital markets and foster trust among participants. Failure to comply with regulatory obligations can have far-reaching implications not only for the individual involved but also for market stability and fairness.

Investors and market participants must adhere to regulatory requirements and ethical standards to uphold the credibility and transparency of the financial system. By promoting a culture of compliance and disclosure, regulators aim to mitigate risks, prevent market abuses, and maintain a level playing field for all investors.

As the case involving Carl Icahn unfolds, it serves as a stark reminder of the importance of regulatory vigilance and enforcement in upholding the integrity of the financial markets. Market participants, irrespective of their stature or influence, must conduct their activities with diligence, probity, and full adherence to legal and regulatory frameworks.

In conclusion, the SEC’s charges against Carl Icahn highlight the imperative for transparency, accountability, and regulatory compliance in the investment landscape. Upholding these principles is essential for fostering investor trust, market efficiency, and overall financial stability. The outcome of this case will be closely watched, underscoring the significance of regulatory oversight in ensuring a fair and transparent marketplace for all.