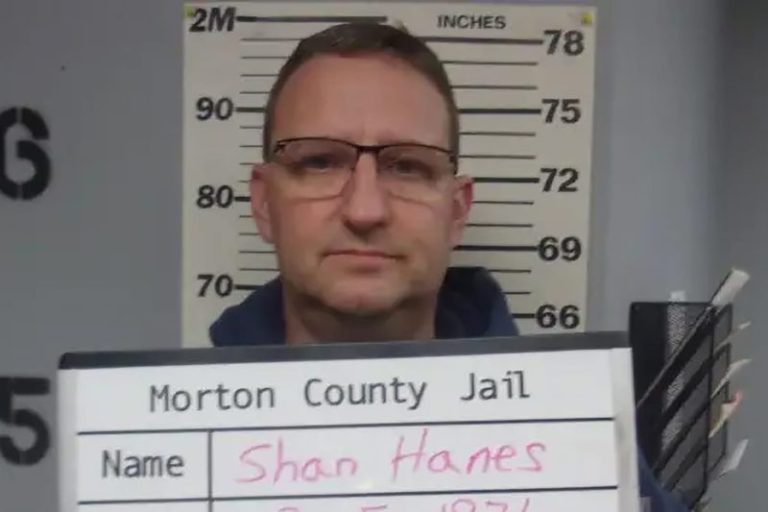

Cryptocurrency Pig-Butchering Scam Wrecks Kansas Bank, Sends Ex-CEO to Prison for 24 Years

The recent case of a cryptocurrency pig-butchering scam that rocked a Kansas bank and resulted in the incarceration of the bank’s ex-CEO for 24 years serves as a cautionary tale for the financial industry and cryptocurrency investors alike. This intricate scheme masterminded by the former CEO involved deceit, misappropriation of funds, and a web of fraudulent activities that ultimately led to the downfall of the bank and the guilt-ridden executive.

The elaborate nature of the scam began with the ex-CEO’s foray into the world of cryptocurrency trading. Utilizing the bank’s resources and customers’ funds, he engaged in high-stakes trading, promising lucrative returns to investors. However, instead of investing the funds as promised, he diverted them into a parallel scheme involving the purchase and slaughter of pigs – a dubious move that raised eyebrows within the banking community.

As the scheme unfolded, the bank’s financial discrepancies became apparent, leading to an investigation that exposed the ex-CEO’s illicit activities. The repercussions were severe, with the bank facing financial ruin and the former executive being sentenced to 24 years in prison for his role in orchestrating the fraudulent scheme.

The fallout from this cryptocurrency pig-butchering scam serves as a stark reminder of the risks associated with unregulated cryptocurrency trading and the importance of due diligence in financial transactions. Investors must exercise caution and conduct thorough research before entrusting their funds to any investment scheme, particularly those involving cryptocurrencies.

Furthermore, the case highlights the crucial role of regulatory oversight in the financial sector to prevent such fraudulent activities from occurring. Institutions must implement robust internal controls and risk management protocols to detect and deter potential scams before they escalate, thereby safeguarding the interests of investors and maintaining the integrity of the financial system.

In conclusion, the cryptocurrency pig-butchering scam that wreaked havoc on the Kansas bank and landed its ex-CEO in prison serves as a cautionary tale for the financial industry. This case underscores the importance of transparency, accountability, and adherence to regulatory standards in all financial transactions to prevent fraud and protect investors’ interests. By learning from such schemes and implementing stringent measures to combat financial misconduct, the industry can strive to uphold trust and integrity in the global financial system.