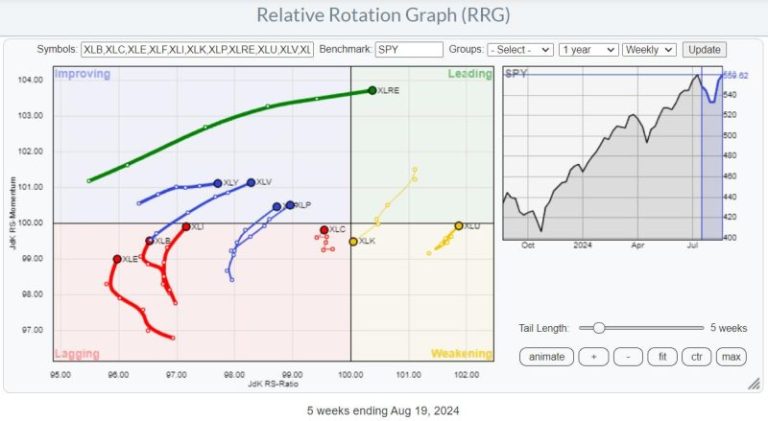

In the ever-evolving world of finance, one particular acronym has been gaining traction and generating buzz among investors – RRG (Relative Rotation Graphs). With its unique visual representation of asset trends, RRG has been lauded as a powerful tool for market analysis and decision-making. This article will delve into RRG Velocity and how it is being utilized by investors to capitalize on opportunities within the financial sector, particularly focusing on the XLF exchange-traded fund.

RRG Velocity is an innovative feature within the RRG framework that provides investors with dynamic insights into the momentum of assets. By measuring the speed at which assets are moving around the RRG chart, Velocity allows investors to gauge the responsiveness of different assets to market trends. This real-time data is especially valuable in the fast-paced world of finance, where timely decision-making can make a significant impact on investment outcomes.

Among the assets that RRG Velocity has been closely tracking is the XLF (Financial Select Sector SPDR Fund), which includes a diverse range of financial stocks such as banks, insurance companies, and financial services firms. By analyzing the movement of XLF within the RRG framework, investors can identify potential opportunities for maximizing returns and managing risk effectively.

One key strategy that investors are employing is to capitalize on the tail winds of XLF within the RRG chart. As XLF gains momentum and moves towards the leading quadrant on the RRG chart, investors are strategically positioning themselves to ride the upward trajectory of this asset. By leveraging the predictive power of RRG Velocity, investors can anticipate market trends and make informed decisions to enhance their portfolio performance.

The beauty of RRG Velocity lies in its ability to provide a clear and intuitive visualization of asset movements, enabling investors to make data-driven decisions with confidence. By understanding the nuances of Velocity and harnessing its predictive capabilities, investors can stay ahead of the curve in the competitive financial landscape.

In conclusion, RRG Velocity offers a valuable tool for investors seeking to navigate the complexities of the financial market and identify lucrative opportunities. By leveraging the insights provided by Velocity within the RRG framework, investors can make informed decisions, optimize their portfolio performance, and capitalize on the momentum of assets such as the XLF exchange-traded fund. As the world of finance continues to evolve, RRG Velocity stands out as a powerful tool for investors looking to stay ahead in a dynamic and ever-changing market environment.