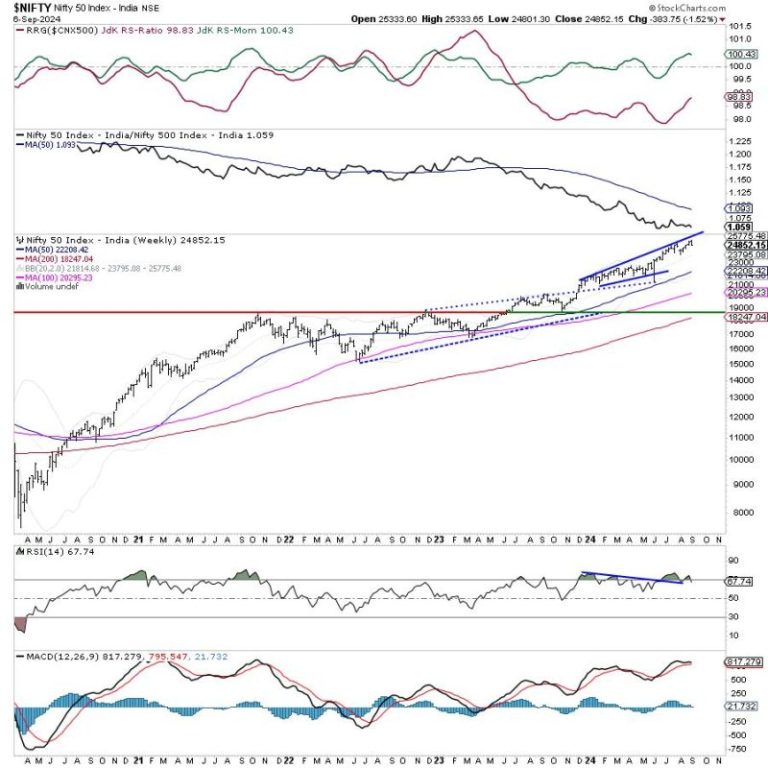

The article you referenced discusses the Nifty index showing early signs of a possible disruption in the uptrend. Given this context, it is crucial for traders and investors to remain cautious and closely monitor the market dynamics in the coming days to make informed decisions. Analyzing the current market situation and key indicators can provide valuable insights into potential trends and help mitigate risks.

Firstly, it is essential to understand the significance of trend analysis in predicting market movements. Trends form the foundation of technical analysis and play a vital role in forecasting future price movements. By identifying early signs of a potential trend reversal, traders can adjust their strategies and positions accordingly to protect their investments and capitalize on emerging opportunities.

Technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands can offer valuable insights into market sentiment and potential trend changes. Monitoring these indicators alongside key support and resistance levels can help traders gauge the strength of the current trend and anticipate possible reversals.

Moreover, market sentiment and external factors such as economic data releases, geopolitical events, and corporate earnings reports can significantly impact market trends. Therefore, staying informed about the latest developments and news can provide traders with a holistic view of the market environment and help them make sound trading decisions.

Risk management is another crucial aspect that traders should prioritize, especially during periods of market uncertainty. Setting stop-loss orders, diversifying portfolios, and maintaining a disciplined approach to trading can help mitigate potential losses and protect capital in volatile market conditions.

In conclusion, while the Nifty index may be showing early signs of a likely disruption in the uptrend, traders and investors can navigate these uncertain waters by adopting a cautious approach, leveraging technical analysis tools, staying informed about market developments, and prioritizing risk management strategies. By taking proactive steps and remaining vigilant, market participants can adapt to changing market conditions and position themselves for success in the ever-evolving financial landscape.