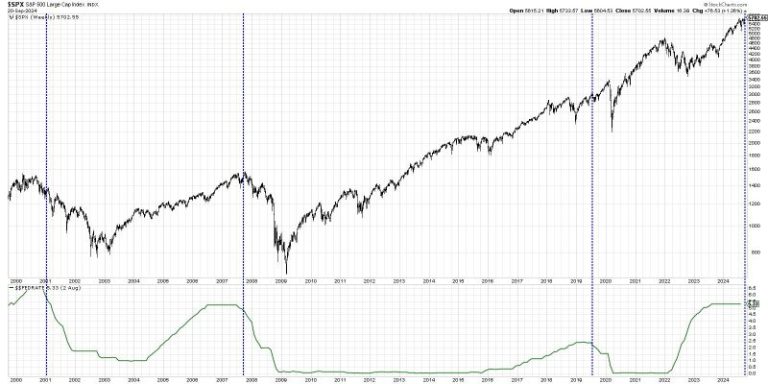

In recent years, investors have closely observed the relationship between interest rate cuts and stock market performance, trying to determine whether a bullish or bearish trend is likely to follow such actions. The Federal Reserve adjusts interest rates to regulate economic growth, inflation, and employment levels, but the impact on stock prices can be less straightforward than expected.

Historically, when central banks cut interest rates, stock markets have tended to respond positively. Lower interest rates typically result in reduced borrowing costs for businesses, boosting their profitability and potentially leading to higher stock prices. Furthermore, lower rates can make equities more attractive compared to fixed-income investments, driving investors towards the stock market and pushing prices higher.

However, the relationship between rate cuts and stock performance is not always so clear-cut. Market volatility, economic conditions, and geopolitical factors can all influence how stocks react to interest rate changes. For example, if rate cuts are perceived as an emergency measure to combat a severe economic downturn, it might signal underlying weakness in the market, leading to a bearish sentiment among investors.

Moreover, the effectiveness of rate cuts in stimulating economic growth and driving stock prices can vary depending on the broader economic landscape. In situations where other macroeconomic indicators are weak or uncertainty looms large, the impact of rate cuts on stock performance may be dampened.

Investors should also consider the expectations and sentiment of market participants when analyzing the potential impact of rate cuts on stock prices. In some cases, if rate cuts are already priced into the market or if they fail to meet investors’ expectations, the positive effect on stocks may be limited.

Looking ahead, the outlook for stock market performance following rate cuts will continue to be influenced by a multitude of factors. While historically, rate cuts have generally been associated with bullish stock market reactions, investors should remain cautious and consider the broader economic context before making investment decisions based solely on interest rate actions.

In conclusion, the relationship between rate cuts and stock market performance is complex and multifaceted. While lower interest rates can often support stock prices by boosting corporate profitability and investor sentiment, various other factors can impact the direction and magnitude of stock market movements following rate cuts. To navigate this landscape successfully, investors must maintain a comprehensive understanding of economic indicators, market dynamics, and evolving trends to make informed investment decisions.