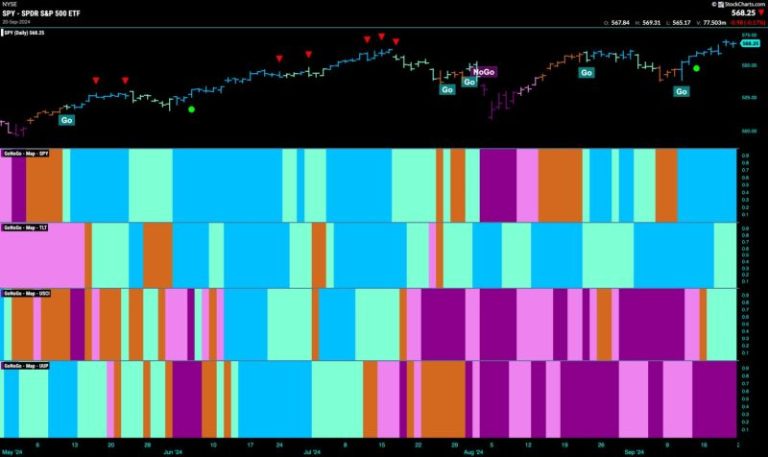

Equities Remain in Strong Go Trend Powered by Financials

The Godzilla Newz article highlights the continued strong performance of equities, driven largely by the financial sector. This trend, often referred to as the Go trend, reflects the resilience of global stock markets despite various challenges. In this analysis, we delve deeper into the dynamics behind this trend and explore the factors that have contributed to the sector’s outperformance.

Financials Leading the Charge

One of the key drivers of the current equity market strength is the robust performance of financial institutions. Banks and other financial services firms have significantly benefited from a favorable economic environment, low interest rates, and increased lending activity. As economic growth continues, financial stocks are poised to capitalize on these favorable conditions, driving overall market performance.

Global Economic Recovery

Another factor supporting the Go trend in equities is the ongoing global economic recovery. Following the disruptions caused by the COVID-19 pandemic, many economies have rebounded strongly, fueled by fiscal stimulus measures and improving consumer confidence. As economic activity picks up pace, businesses across various sectors are expected to witness growth, translating into higher stock valuations.

Technological Advancements

The article rightly points out the role of technological advancements in shaping the current equity market landscape. Tech companies, in particular, have been at the forefront of driving innovation and disrupting traditional industries. As digitalization continues to expand, companies leading the tech revolution are likely to sustain their growth trajectory, attracting investor interest and bolstering equity markets.

Inflation Concerns and Policy Decisions

Despite the positive momentum in equities, lingering concerns about inflation and potential policy shifts present challenges to the Go trend. Rising inflation could erode purchasing power and impact corporate earnings, leading to market volatility. Furthermore, central banks’ decisions regarding interest rates and asset purchase programs could influence investor sentiment and equity market performance in the coming months.

Diversification and Risk Management

To navigate the evolving equity market environment, investors are advised to focus on diversification and risk management strategies. By spreading investments across different asset classes and geographies, investors can mitigate potential risks and enhance portfolio resilience. Moreover, maintaining a long-term perspective and staying informed about macroeconomic trends can empower investors to make informed decisions amid market fluctuations.

Looking Ahead

As equities continue to exhibit strength supported by the financial sector and other key drivers, investors should remain vigilant and adapt their strategies to changing market conditions. By monitoring market developments, staying informed about global economic trends, and implementing prudent risk management practices, investors can position themselves to capitalize on investment opportunities while managing potential risks effectively. Ultimately, maintaining a disciplined approach and seeking professional advice can help investors navigate the dynamic equity market landscape and achieve their financial objectives.