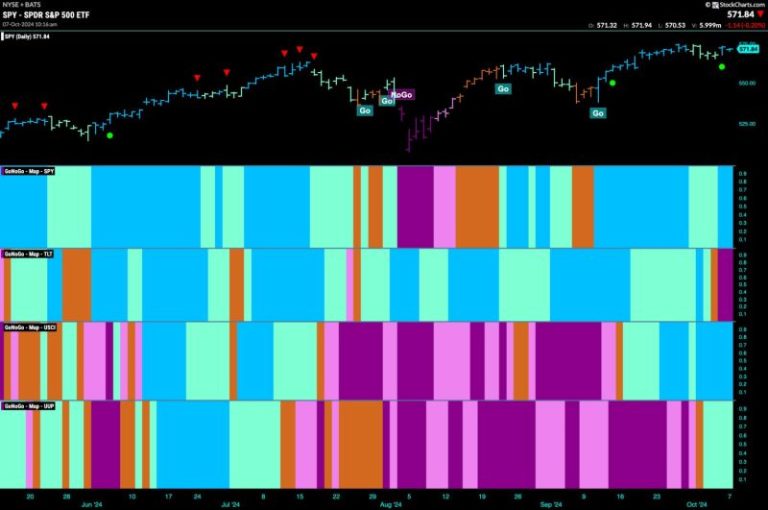

Equities Remain in ‘Go’ Trend and Lean into Energy

The stock market has been a hot topic of discussion lately, with investors closely tracking the trends and movements of various equities. One particular sector that has been garnering attention is the energy industry, as equities in this sector have shown promising signs of growth and potential.

In recent weeks, equities in the energy sector have remained in a go trend, indicating positive momentum and investor interest. This trend suggests that investors are optimistic about the prospects of energy companies and are confident in their potential for growth.

One of the factors contributing to this positive trend is the increasing demand for energy sources, driven by economic recovery and the gradual reopening of businesses post-pandemic. As economic activities resume and industries ramp up production, the need for energy is expected to rise, benefiting energy companies and boosting their stock prices.

Furthermore, advancements in renewable energy technologies have also played a crucial role in fueling investor interest in the energy sector. Companies focusing on renewable energy sources such as solar, wind, and hydroelectric power are seen as sustainable long-term investments, appealing to investors looking for environmentally conscious options.

Additionally, government initiatives and policies aimed at promoting clean energy and reducing carbon emissions have provided further support for equities in the energy sector. Investors are increasingly viewing companies that align with these initiatives favorably, positioning themselves to benefit from the transition towards a greener economy.

Moreover, the recent surge in oil prices has also bolstered the performance of energy equities, as higher oil prices typically translate to increased revenues and profitability for oil and gas companies. This price uptrend has reinforced investor confidence in the sector and has contributed to the overall positive sentiment towards energy equities.

Overall, equities in the energy sector are currently experiencing a favorable phase, characterized by a go trend and increasing investor interest. Factors such as rising energy demand, advancements in renewable energy technologies, government support for clean energy initiatives, and surging oil prices have all contributed to the positive outlook for energy companies.

As investors continue to monitor market trends and capitalize on opportunities in the energy sector, it remains essential to conduct thorough research and due diligence before making investment decisions. By staying informed and proactive, investors can make well-informed choices that align with their financial goals and risk tolerance, ultimately positioning themselves for potential growth and success in the dynamic world of equities.