In the realm of financial markets, it is imperative for investors and traders to closely monitor key levels and trends to make informed decisions and navigate uncertainties efficiently. The stock market is a dynamic arena where various factors influence the movement of indices and individual stocks. As the Nifty consolidates, maintaining awareness and staying attuned to critical levels becomes paramount for strategizing and optimizing trading opportunities.

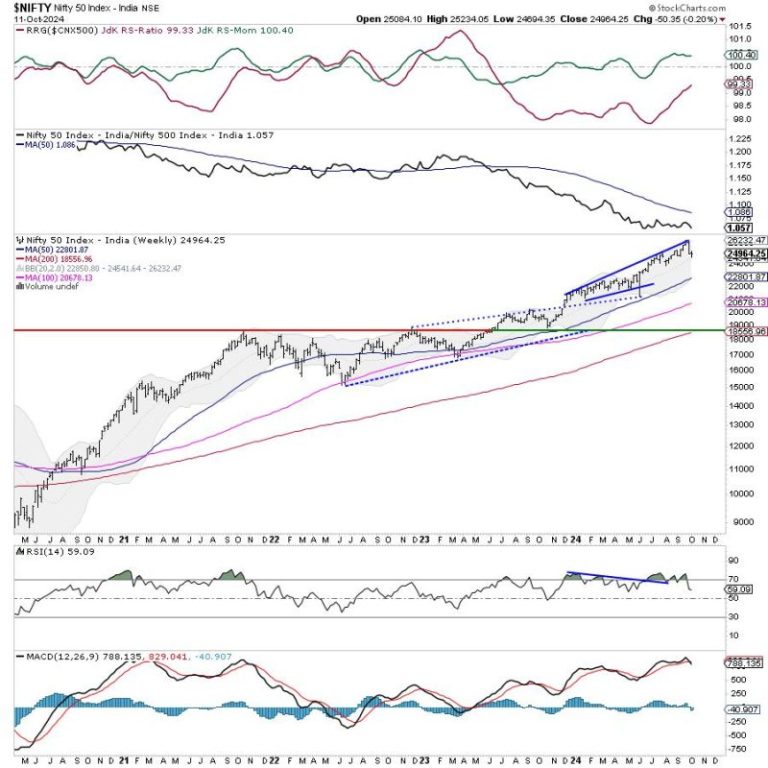

One of the essential aspects to consider during consolidation phases is the support and resistance levels. These levels act as crucial markers that reflect the market sentiment and potential price action. By closely monitoring the Nifty’s movement and ensuring that it remains above key support levels, traders can gauge the underlying strength and resilience of the market. Failing to hold these support levels could indicate a weaker market sentiment and potentially lead to further downside momentum.

In addition to support levels, resistance levels also play a vital role in guiding trading decisions. These levels represent barriers that the market must overcome to establish a bullish trend. By observing the Nifty’s ability to break through resistance levels, traders can identify potential breakout opportunities and capitalize on upward price movements. Conversely, encountering strong resistance could signal a shift in market sentiment and trigger a correction or consolidation phase.

Furthermore, the concept of consolidation itself offers insights into market dynamics and potential trading strategies. Consolidation typically occurs after a significant price movement and reflects a period of market indecision and equilibrium. During consolidation phases, traders can employ range-bound strategies, such as trading within a defined price range or using technical indicators to identify potential breakouts.

Another critical factor to consider when navigating the stock market is the impact of external events and news developments. Geopolitical tensions, economic data releases, corporate earnings reports, and other external factors can significantly influence market sentiment and trigger abrupt price movements. Being mindful of upcoming events and news announcements can help traders anticipate market volatility and adjust their trading strategies accordingly.

Moreover, technical analysis tools and indicators can provide valuable insights into market trends and potential price movements. By using tools such as moving averages, relative strength index (RSI), and Fibonacci retracement levels, traders can make informed decisions based on historical price data and market patterns. These technical indicators can help identify support and resistance levels, trend reversals, and potential entry and exit points.

In conclusion, staying vigilant and proactive in monitoring key levels and trends is essential for navigating the stock market successfully. By understanding the significance of support and resistance levels, employing range-bound strategies during consolidation phases, staying informed about external events, and utilizing technical analysis tools, traders can enhance their decision-making process and optimize trading outcomes. Ultimately, a combination of market awareness, strategic planning, and risk management is crucial for achieving sustainable success in the dynamic world of stock trading.