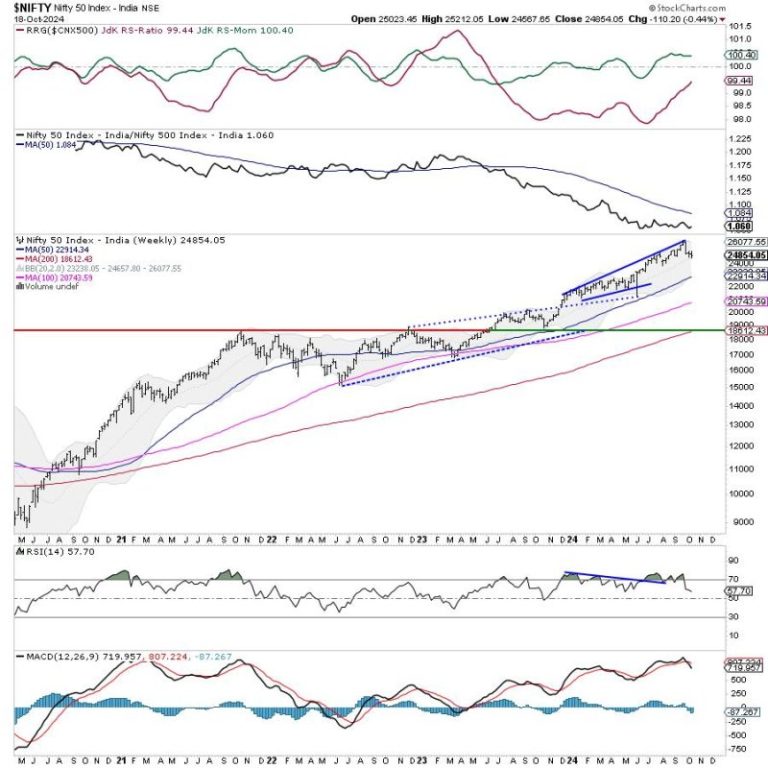

As we enter a new week of trading in the market, investors are anticipating the behavior of the Nifty index. The previous sessions have seen the Nifty maintaining a range-bound movement, prompting traders to look for potential breakout points to engage in trend-following strategies. The prospects of a directional move in the market are critically dependent on certain key levels being breached.

Technical analysts suggest that Nifty is likely to stay within a narrow range in the upcoming sessions unless pivotal support and resistance levels are decisively broken. Traders are advised to closely monitor these levels and act accordingly to capitalize on potential trending movements.

One of the essential technical levels to watch out for is the support around 14,250. A breach below this level could signal a bearish sentiment in the market, potentially leading to a downward trend. On the other hand, the resistance at 14,600 is crucial for a bullish breakout. A successful breach above this level could trigger considerable upside momentum in the market.

Another pivotal factor impacting the Nifty’s movement is the ongoing earnings season. The quarterly financial results of companies can significantly influence market sentiment and drive prices in either direction. Investors should pay close attention to the corporate earnings announcements and incorporate them into their trading decisions.

Moreover, external factors such as global market trends, geopolitical events, and economic indicators could also sway market sentiment and contribute to the Nifty’s behavior. Traders need to stay informed about these external factors and adapt their strategies accordingly to mitigate risks and capitalize on opportunities.

In conclusion, the week ahead for the Nifty index is poised for potential trending moves, provided that key technical levels are breached decisively. Traders are advised to stay vigilant, monitor critical support and resistance levels, and remain adaptable to changing market conditions. By staying informed and adopting a disciplined approach, investors can navigate the market dynamics effectively and make informed trading decisions.