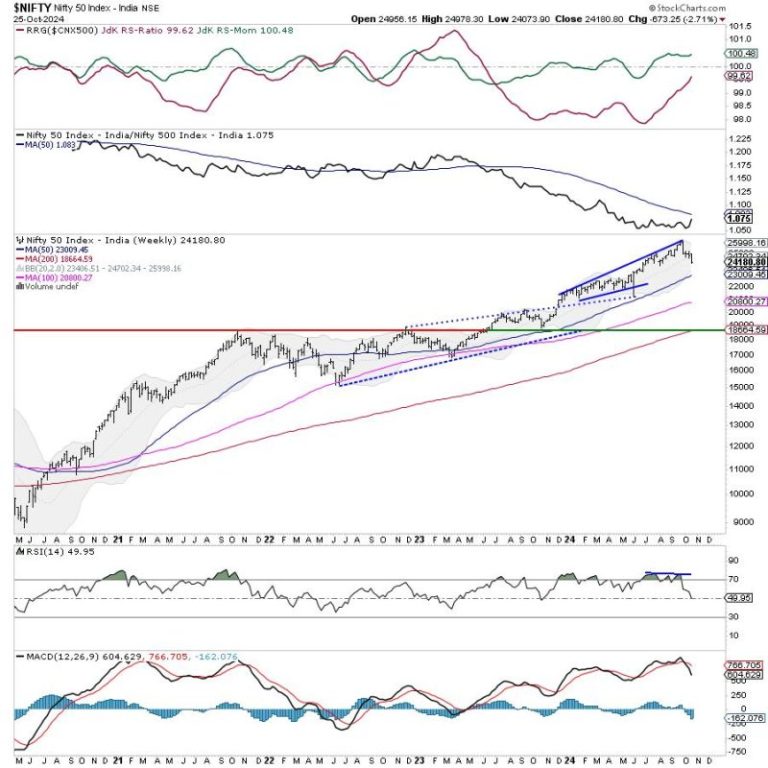

The article titled Week Ahead: Nifty Violates Key Support Levels, Drags Resistance Lower from Godzilla Newz discusses the recent movement of the Nifty index in the stock market. The article highlights the violation of key support levels by the Nifty index and how it has negatively impacted the resistance levels. The analysis provided in the article suggests a cautious outlook for the upcoming week based on technical indicators and trend analysis.

The article begins by pointing out the Nifty’s breach of key support levels, indicating a bearish sentiment in the market. This deviation from the support levels signifies a weakening of the market and a potential shift in momentum towards the downside. The article emphasizes the importance of tracking support and resistance levels to gauge the market’s direction and make informed trading decisions.

Furthermore, the article mentions the impact of the violation of key support levels on the resistance levels. As the support levels give way, the resistance levels are likely to be dragged lower, making it harder for the index to reclaim higher levels. This analysis suggests a formidable barrier for the Nifty index to break through in the short term, hindering potential recovery or upward movement.

Technical indicators are also cited in the article to support the bearish outlook for the Nifty index. The RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) indicators are mentioned as showing signs of weakness and suggesting a potential continuation of the bearish trend. These indicators serve as tools for traders and investors to assess market conditions and anticipate future price movements.

In conclusion, the article advises readers to exercise caution and remain vigilant in the face of the Nifty index’s recent breakdown of key support levels. By closely monitoring technical indicators, support and resistance levels, and market trends, traders can position themselves strategically and adapt to the evolving market dynamics. The article underscores the importance of staying informed and making data-driven decisions in navigating the volatile stock market environment.