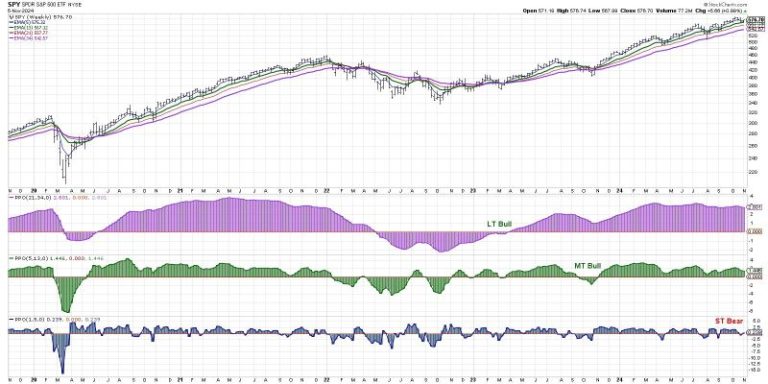

In the world of finance, short-term signals play a crucial role in guiding investors and shaping market sentiment. This week, the markets are gearing up for a news-heavy period that could potentially impact trading dynamics. As traders brace themselves for the influx of information, it is important to dissect the current bearish signal and its potential implications.

The recent short-term bearish signal observed in the markets has raised concerns among investors, indicating a possible shift in market sentiment. This signal could be attributed to a variety of factors, including geopolitical tensions, economic data releases, or corporate earnings reports that are influencing market participants’ outlook.

Geopolitical tensions have been a key driver of market volatility in recent times, with events such as trade disputes, political instability, or military conflicts leading to shifts in investor sentiment. The uncertainty surrounding these issues can create a risk-off environment, prompting investors to adopt a more cautious approach in their trading decisions.

Moreover, economic data releases can also have a significant impact on market dynamics, as they provide insights into the health of the economy and potential policy actions by central banks. A string of disappointing economic indicators or unexpected data points can trigger market reactions, leading to increased volatility and a bearish bias.

Another factor contributing to the bearish signal is the upcoming corporate earnings season, where companies release their financial results for the previous quarter. Earnings reports often serve as a barometer for the overall health of the economy and specific industries, with surprises or disappointments influencing investor confidence and stock valuations.

As markets prepare for a news-heavy week, traders need to be vigilant and adaptable in their approach to navigate through potential uncertainties. It is essential to stay informed about the latest developments, analyze market trends, and consider risk management strategies to protect investments during volatile periods.

In conclusion, while short-term bearish signals may be unsettling for investors, they also present opportunities for astute traders to capitalize on market inefficiencies and fluctuations. By staying informed, maintaining a disciplined approach, and utilizing risk management tools, investors can navigate through challenging market conditions and position themselves for long-term success.