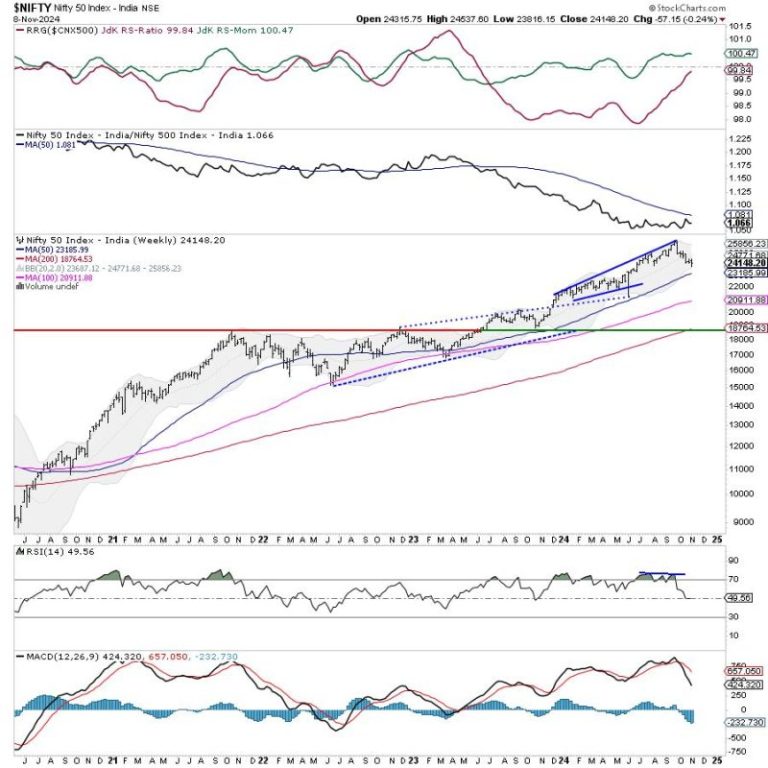

The stock market in India has been facing a period of sluggishness recently, with the Nifty index struggling to make significant gains. As we look ahead to the coming week, there are several factors that suggest this sluggish trend may continue. Multiple resistance levels are currently presenting challenges for the Nifty, making it difficult for the index to push higher.

Technical analysis can provide valuable insights into the likely direction of the market in the coming days. Looking at the Nifty chart, we can see that the index is currently hovering near a key resistance zone. This zone has acted as a hindrance to upward movements in the past, and it is likely to continue to do so in the near term.

In addition to these technical barriers, there are also fundamental factors at play that could weigh on the Nifty in the week ahead. Economic uncertainties, both domestic and global, have been causing volatility in the markets, and this volatility is likely to persist in the coming days.

One key factor that investors will be keeping an eye on is the upcoming earnings season. Corporate earnings reports can have a significant impact on stock prices, and if companies are unable to meet market expectations, it could further dampen investor sentiment and hinder the Nifty’s progress.

Another factor that could influence the market in the week ahead is the ongoing geopolitical tensions. With uncertainties surrounding various global issues, such as trade conflicts and political instability, investors may adopt a cautious approach, leading to subdued market activity.

Furthermore, the upcoming Reserve Bank of India (RBI) policy meeting could also have an impact on the market. Any decisions or statements made by the RBI regarding monetary policy could sway investor confidence and affect the direction of the Nifty.

In light of these multiple resistances, both technical and fundamental, it is likely that the Nifty will face challenges in making substantial gains in the week ahead. Investors should remain vigilant and keep a close watch on market developments to navigate these uncertain times effectively.