In recent years, the demand for chromium has been on the rise as it is an essential element used in various industries. Investors looking to capitalize on the growing demand for chromium often turn to investing in chromium stocks. Investing in chromium stocks can be a lucrative venture if approached strategically and with a good understanding of the market dynamics and the factors influencing the chromium industry.

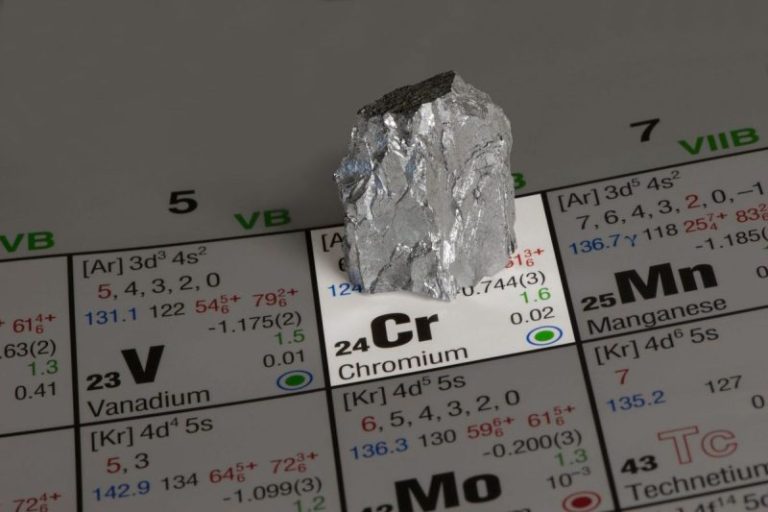

To begin with, it’s important for investors to understand the basics of chromium and its uses. Chromium is a versatile element that is primarily used in the production of stainless steel, which finds applications in various industries such as automotive, aerospace, construction, and more. With the increasing demand for stainless steel globally, the demand for chromium is also expected to rise, making it an attractive investment opportunity.

When investing in chromium stocks, one of the key factors to consider is the global supply and demand dynamics of chromium. Investors should keep an eye on the production levels of chromium in major producing countries such as South Africa, Kazakhstan, and India, as well as the consumption trends in key markets like China, the United States, and the European Union. Any disruptions in the supply chain or changes in demand can have a significant impact on chromium prices and, consequently, on the stock prices of chromium producers.

Furthermore, investors should also consider the financial health and operational efficiency of the companies in which they are looking to invest. Conducting thorough research on the company’s financial statements, growth prospects, management team, and competitive positioning can provide valuable insights into the company’s potential for long-term growth and profitability. Investing in companies with a strong track record of performance and a sustainable business model can help mitigate risks and enhance returns.

In addition to individual chromium producers, investors can also consider investing in exchange-traded funds (ETFs) or mutual funds that have exposure to the metals and mining sector, including chromium. These funds offer diversification benefits by investing in a portfolio of companies across the industry, reducing the risk associated with investing in individual stocks. Investors can choose funds that align with their investment objectives and risk tolerance to gain exposure to the chromium market.

It’s important for investors to keep abreast of the latest developments in the chromium industry, including technological advancements, regulatory changes, and geopolitical events that may impact the market. Staying informed and being proactive in monitoring market trends can help investors make informed decisions and adjust their investment strategies accordingly to maximize returns and manage risks effectively.

In conclusion, investing in chromium stocks can be a rewarding opportunity for investors looking to capitalize on the growing demand for this essential metal. By understanding the market dynamics, conducting thorough research, and staying informed about industry trends, investors can make well-informed decisions to build a profitable portfolio of chromium investments. As with any investment, it’s crucial for investors to assess their risk tolerance, set realistic expectations, and diversify their portfolio to achieve long-term financial goals.