In the fast-paced realm of technology and investing, semiconductor exchange-traded funds (ETFs) have been gaining significant attention due to their exposure to the booming semiconductor industry. Two prominent ETFs in this space, VanEck Vectors Semiconductor ETF (SMH) and iShares PHLX Semiconductor ETF (SOXX), have been closely scrutinized by investors and analysts alike for their performance and resilience during times of market turbulence.

Upon closer inspection, it becomes apparent that SMH has been holding up better than SOXX during recent market fluctuations. One of the primary reasons for this divergence in performance can be attributed to the differences in their respective compositions and weightings.

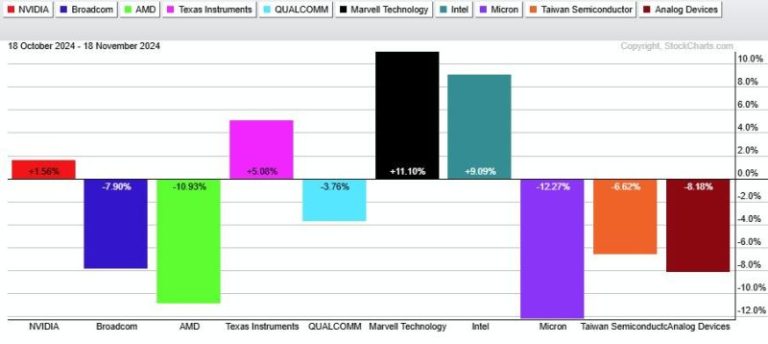

SMH, which tracks the MVIS US Listed Semiconductor 25 Index, consists of a concentrated portfolio of semiconductor companies, with top holdings including giants like NVIDIA, Qualcomm, and Intel. On the other hand, SOXX follows the PHLX SOX Semiconductor Sector Index, which includes a broader range of semiconductor-related companies.

The concentrated nature of SMH’s portfolio has enabled it to benefit from the outperformance of its top holdings, which have shown resilience and strong growth prospects in the face of market volatility. In contrast, the broader composition of SOXX has exposed it to a wider array of companies, some of which may not have fared as well during turbulent market conditions.

Furthermore, the ongoing global semiconductor shortage has significantly impacted the industry, with certain companies facing supply chain disruptions and production delays. As a result, investors have favored ETFs like SMH, which have a more focused exposure to key players that are better positioned to navigate these challenges.

Another factor contributing to SMH’s relative strength is the market’s preference for companies that are at the forefront of technological innovation and are driving advancements in areas such as artificial intelligence, cloud computing, and 5G. Many of SMH’s top holdings are leaders in these cutting-edge fields, which has bolstered investor confidence in the ETF’s long-term growth potential.

In conclusion, the tale of these two semiconductor ETFs underscores the importance of considering factors such as composition, concentration, and industry trends when evaluating investment opportunities. While both SMH and SOXX offer exposure to the semiconductor sector, the unique characteristics of each fund have resulted in varying performances during turbulent market conditions. As the semiconductor industry continues to evolve and face challenges, investors will need to stay vigilant and discerning in their selection of ETFs to capitalize on the sector’s growth opportunities.