The following is a guest post and opinion from Dr. Jae S. Jeong, Co-Founder and CTO, Gurufin.

Today’s stablecoins are an extension of the U.S. financial system. Backed by the U.S. Dollar, they are tied to its monetary policy and indirectly answerable to its policy goals. This allegiance is useful to some, but not all. Here’s why.

One myth in the digital asset world is the idea that eventually, a single digital currency will dominate global payments and commerce. With stablecoins, proponents of that myth have pointed to the U.S. Dollar, with its deep liquidity and global status, as a natural stepping stone.

There’s a widespread belief that U.S. Dollar-pegged stablecoins will inevitably become the world’s primary digital settlement layer. But a closer look at the economic realities on the ground in Asia suggests a very different future is taking shape: a future driven not by global ambitions, but by the practical, pressing needs of local economies.

The Dollar’s Shadow

This is a matter of practicality and national interest. Asian nations’ diverse needs will foster an array of local-currency stablecoins, empowering central bankers to hedge against a dollar-denominated digital financial system.

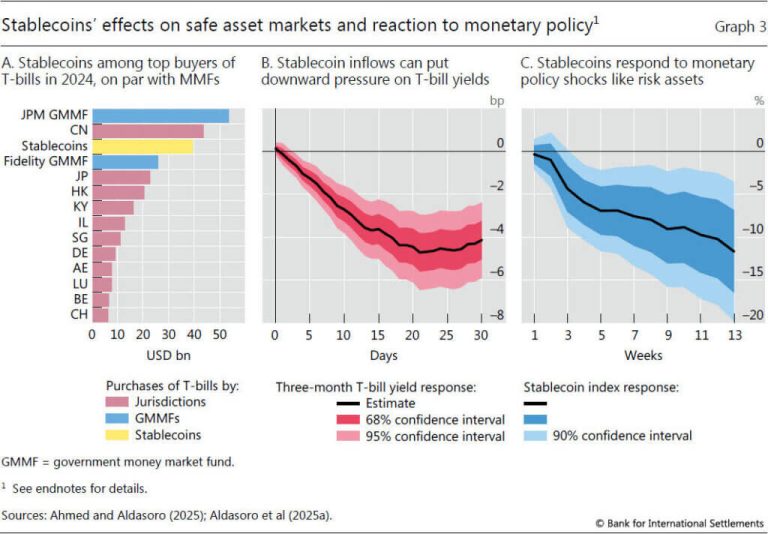

Today, the digital asset ecosystem is indeed cast in the dollar’s shadow. USD-pegged stablecoins like USDT and USDC dominate trading volume, acting as a digital gateway to the crypto markets. Since the 2024 U.S. elections, support has grown—especially for models holding U.S. government debt as reserves.

This status quo works well for the U.S. and the proponents of this myth. However, there are those peeking out from under the dollar’s shadow.

The first reason has nothing to do with digital assets. Yields on Treasuries spiked as trade and tariff policy seesawed. Non-U.S. companies and governments still hold Treasuries, but the evaluation of their risk has changed. This change can be seen in the rise in central bank gold reserves.

Second, U.S. allies from Europe to Southeast Asia are rethinking the benefits of tying their trade and monetary policies to America. Dollarization, or the process of local economies becoming reliant on the U.S. Dollar, was always a cautionary tale in emerging markets. The Asian Financial Crisis was precipitated by the mismatch in Asian companies borrowing in U.S. Dollars and earning revenue in local currencies. Now, U.S. Dollar stablecoins are seen in many emerging economies as the fast track to dollarization.

This hints at the third problem, which is that monetary policy must be in service to local economic growth. Developed as a tool for national rejuvenation, modern central banks need instruments they can control to the benefit of their constituents.

By adopting U.S. Dollar stablecoins, central bankers in emerging economies—particularly, but not exclusively, in Asia—would lose the ability to use their exchange rate as a tool to absorb external shocks, especially when they occur counter to the U.S. economic cycle.

The Bank for International Settlements has already highlighted the risk of “currency substitution.” Financial regulators outside the U.S. understand the difference between this reality and the myth of Dollar dominance.

Stablecoin Pluralism

Emerging Asian economies can leverage the desire for stablecoins to reinforce their local monetary strength. Central bankers must separate the benefits of the cheaper, faster, 24/7 payment rails that stablecoins provide from the Dollar-denominated assets that have so often been their reserves.

Some are already seizing that moment. The Monetary Authority of Singapore has finalized a regulatory framework for single-currency stablecoins. This clear licensing path supports the issuance of a stablecoin pegged to the Singapore Dollar, enabling corporate treasurers to leverage it for faster, cheaper settlement for commercial payments and to streamline cross-border payments within the region.

Japan’s updated Payment Services Act allows banks and licensed trust companies to issue yen-backed stablecoins. In response, SBI, Circle, Ripple, and Startale recently announced plans to jointly launch a Yen-backed stablecoin. Monex and local fintech, JPYC, are also planning local stablecoins.

For the Philippines, stablecoins are an immediate solution to the high fees and slow speeds of $3 billion in monthly remittances. A small business owner can now accept payments from overseas clients using a regulated stablecoin, instantly bypassing card network fees and receiving funds in minutes rather than days.

By developing and regulating their own local-currency stablecoins, Asian central banks can retain control over their financial systems and actively shape the digital future, rather than simply reacting to it. This model can be replicated across Asia’s deep trade corridors, allowing a web of interoperable stablecoins to speed up settlement and reduce dependence on the U.S. Dollar in intra-Asia trade.

The opportunity is even more attractive for Asia’s major trading houses. Many of Asia’s 20th-century economies modernized around a small number of major conglomerates. In Japan, Korea, Hong Kong, Indonesia, the Philippines, and India, these conglomerates benefit from strong local stablecoins that can reduce friction in the flow of goods and capital between Asian businesses.

Even local merchants and small and medium-sized enterprises stand to gain. Stablecoins allow merchants to bypass the fees and settlement risk of traditional card networks.

Stablecoins’ Next Chapter

Stablecoins are an extension of the U.S. monetary system, but they don’t have to be.

Central bankers and financial regulators from Pakistan to Korea are wrestling with how to safely allow the best parts of stablecoin innovation into their economies, without accepting dollarization as a foregone conclusion. There are precedents in traditional monetary policy. Singapore has a strong local currency, separate from the U.S. Dollar, and it punches well above its weight in terms of global trade.

Innovation is about making better systems, not just replicating the old ones. Asian financial policymakers can separate fast payment rails from reserve assets, preserve room for monetary policymaking, and focus on high-value intra-Asia payment corridors.

A pluralistic stablecoin future is not yet a reality. But as with all myths, it tells a story worth pursuing.

The post Asian stablecoins: The myth of dollar dominance appeared first on CryptoSlate.