Two of the largest digital asset managers, Bitwise and 21Shares, have made a notable update to their Ethereum and Solana ETF filings that could signal a shift in how crypto exchange-traded products operate in the United States.

According to amended S-1 statements filed with the U.S. Securities and Exchange Commission (SEC), both issuers now reference the possibility of staking Ethereum and Solana holdings within their funds.

If approved, this change would allow these ETFs to earn staking rewards, the income generated by helping validate transactions on proof-of-stake blockchains. Until now, U.S.-listed crypto ETFs have been limited to holding underlying assets passively, without the ability to participate in network consensus.

The amended filings, submitted this week, come after several months of quiet lobbying from ETF issuers seeking regulatory clarity around staking income. While the inclusion of this language does not mean the SEC has approved the feature, it indicates that the agency is at least considering the idea.

Analysts view this as an early sign that the SEC’s stance on staking may be softening, especially given the growing pressure to allow ETFs to compete with on-chain yield opportunities available to retail and institutional investors abroad.

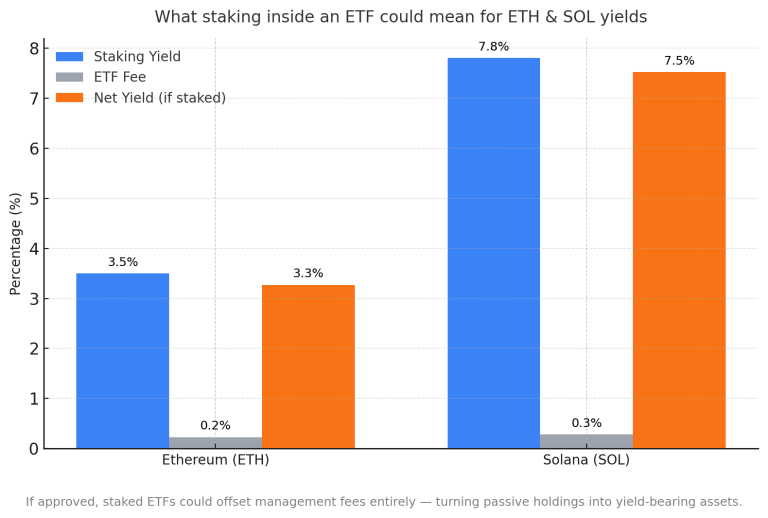

What staking inside an ETF could mean for ETH and SOL yields

For Ethereum, current staking rewards range between 3% and 4%, while Solana’s rewards typically fall between 7% and 8% annually. ETF management fees for these funds are generally around 0.20% to 0.30%, meaning that if staking proceeds are distributed to holders, the yield could cover or even exceed the fund’s fees.

Such a change could transform how ETF issuers compete in the market. Instead of focusing solely on management costs and liquidity, future funds may also compete on net yield, creating a new performance metric for investors comparing crypto ETFs.

While the SEC has not yet commented on these amendments, the filings suggest that staking could soon move from the on-chain economy into traditional financial products, bridging a gap between DeFi incentives and regulated investment vehicles.

The post SEC filing reveals ETH and SOL ETFs may include staking rewards appeared first on CryptoSlate.