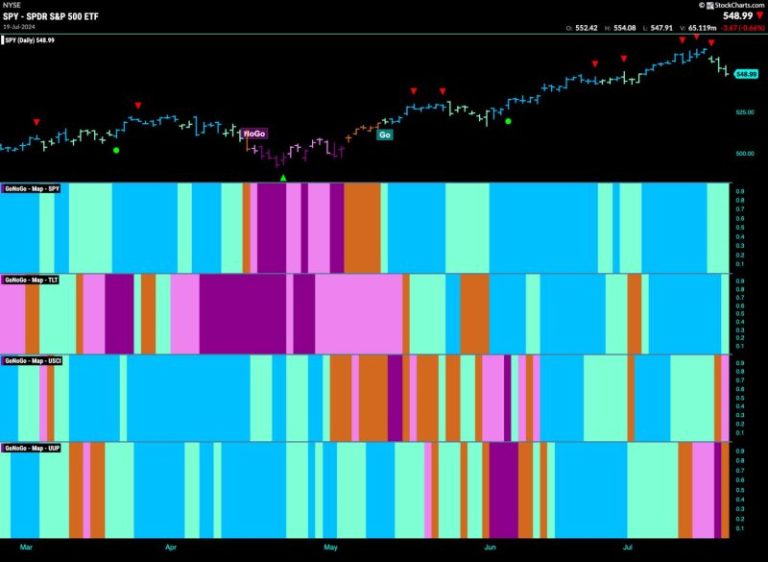

In the world of finance and investing, trends are constantly shifting, leading to changing dynamics in the market. Recently, there has been a noticeable transition in the financial landscape, with financials beginning to outperform other sectors as the equity go trend weakens. This shift has sparked interest and concern among investors and analysts alike, as they try to decipher the underlying reasons and implications of this trend reversal.

One of the key factors driving the outperformance of financials is the changing interest rate environment. In a low-interest-rate environment, financial institutions typically struggle to generate profits as their margins are squeezed. However, as interest rates begin to rise, financial companies stand to benefit from higher yields on their investments and loans. This has led investors to flock towards financial stocks in anticipation of improved profitability and returns.

Furthermore, the regulatory environment has also played a significant role in boosting the performance of financial stocks. The rollback of certain regulations and policies that were put in place in the aftermath of the financial crisis has provided a more favorable operating environment for financial institutions. This deregulatory push has given financial companies more flexibility in managing their operations and has fueled optimism among investors regarding the sector’s growth prospects.

Moreover, technological advancements have revolutionized the way financial services are delivered, leading to increased efficiency and cost savings for financial institutions. This digital transformation has enabled financial companies to streamline their processes, enhance customer experience, and drive revenue growth. As a result, investors have shown confidence in the future prospects of financial stocks, pushing their prices higher and contributing to their outperformance.

Despite the strong performance of financials, the equity go trend has shown signs of weakening, reflecting a shift in investor sentiment towards more defensive sectors. This trend reversal has raised concerns among investors who have become accustomed to the dominance of growth-oriented stocks in recent years. However, some analysts view this as a healthy rotation in the market, as investors diversify their portfolios and seek opportunities in undervalued sectors such as financials.

In conclusion, the recent outperformance of financials amidst a weakening equity go trend underscores the dynamic nature of the financial markets. Factors such as rising interest rates, regulatory changes, and technological advancements have contributed to the resurgence of financial stocks, attracting investor interest and reshaping market dynamics. While the shifting trends may pose challenges for some investors, they also present opportunities for those who are able to adapt and capitalize on the evolving market conditions.