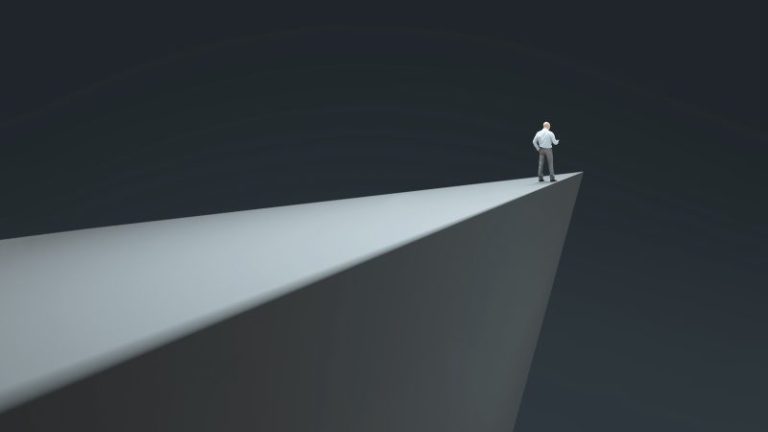

In the fast-paced world of finance, the Nasdaq Composite Index has been a key barometer of technological performance, standing as a significant indicator of the health of the tech sector. Recent market fluctuations have highlighted the importance of critical levels that investors and traders should closely monitor when Nasdaq teeters on the edge.

One critical level to watch is the Nasdaq’s 50-day moving average. This moving average provides insight into the index’s short-term momentum and helps identify potential trend reversals. Traditionally, when the Nasdaq falls below its 50-day moving average, it may signal a shift from a bullish to a bearish trend, prompting investors to exercise caution in their market decisions.

Another pivotal level for monitoring is the Nasdaq’s support and resistance levels. Support levels indicate the price points at which the index has previously found buying interest, often serving as a floor that prevents further downward movement. On the other hand, resistance levels represent price points where selling pressure typically emerges, hindering the index’s upward progress. By identifying these support and resistance levels, investors can anticipate potential price movements and adjust their trading strategies accordingly.

Moreover, the Relative Strength Index (RSI) plays a crucial role in assessing the Nasdaq’s overbought or oversold conditions. The RSI is a momentum oscillator that ranges from 0 to 100, with readings above 70 suggesting overbought conditions and readings below 30 signaling oversold conditions. Monitoring the Nasdaq’s RSI can help investors gauge the index’s current momentum and make informed decisions based on market sentiment.

Additionally, volume analysis is essential when evaluating the Nasdaq’s critical levels. Changes in trading volume can provide valuable insights into the strength of market movements, with increasing volume often confirming price trends. By correlating volume data with price movements at key levels, investors can better interpret market sentiment and make informed trading decisions.

In conclusion, monitoring critical levels is essential when navigating the uncertainties of the financial market, especially as the Nasdaq teeters on the edge. By closely watching indicators such as moving averages, support and resistance levels, the Relative Strength Index, and trading volume, investors can gain a deeper understanding of market dynamics and position themselves strategically to capitalize on opportunities while managing risks effectively.