Sector Rotation Dilemma: Balancing Risk and Return

The concept of sector rotation in investing has long been a strategy employed by many investors seeking to capitalize on economic cycles and market trends. While the potential benefits of sector rotation are evident, navigating this strategy can present a dilemma when it comes to balancing risk and return.

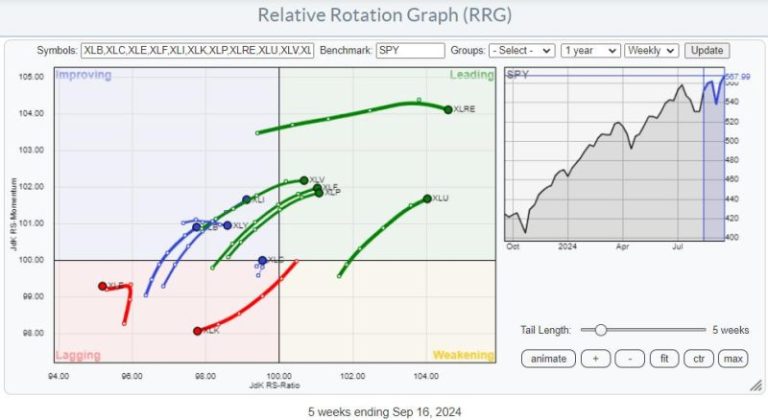

Sector rotation involves systematically shifting investments among different sectors of the economy based on their performance relative to the broader market. The idea is to be overweight in sectors expected to outperform and underweight in sectors likely to lag. This strategy relies on the notion that different sectors excel at different stages of the economic cycle, allowing investors to adjust their portfolios accordingly.

One of the primary challenges in sector rotation is the difficulty of accurately predicting sector performance. Economic factors, market sentiment, geopolitical events, and unforeseen events can all influence sector performance in ways that are difficult to predict. As a result, investors may find themselves facing the dilemma of choosing between potential upside and increased risk.

Another aspect of the sector rotation dilemma is the temptation to chase returns. In a dynamic market environment, it can be easy to be swayed by recent sector performance and make rapid changes to a portfolio in pursuit of short-term gains. However, such knee-jerk reactions can backfire, as sectors that have recently outperformed may be poised for a correction, while sectors that have underperformed may present long-term value.

Moreover, the cost associated with frequent trading can erode returns and diminish the effectiveness of the sector rotation strategy. Transaction costs, taxes, and the emotional toll of constant portfolio adjustments can detract from the overall performance of the investment strategy. To mitigate this risk, investors must strike a balance between active management and a long-term perspective.

On the flip side, a passive approach to sector rotation may lead to missed opportunities and suboptimal returns. Failing to adjust a portfolio in response to changing market dynamics can result in underperformance compared to more active strategies. Balancing the need for proactive management with the discipline to stay the course is key to navigating the sector rotation dilemma.

In conclusion, sector rotation can be a powerful investment strategy for those willing to put in the necessary research and effort. By carefully weighing the risks and rewards of sector rotation and maintaining a disciplined approach to portfolio management, investors can navigate the sector rotation dilemma and potentially enhance their long-term returns. Striking a balance between active management and a long-term perspective is essential for successfully implementing a sector rotation strategy.