In the fast-paced world of trading and investing, it can be overwhelming to keep up with the constant fluctuations in the market. From economic indicators to geopolitical events, numerous factors can influence the stock market in any given week. As traders and investors, it is crucial to analyze and interpret these market moves accurately to make informed decisions and stay ahead of the curve.

One key index to watch closely is the Nifty, which represents the performance of the top 50 companies listed on the National Stock Exchange of India. The Nifty serves as a barometer of the Indian equity market and provides valuable insights into the overall sentiment and direction of the market.

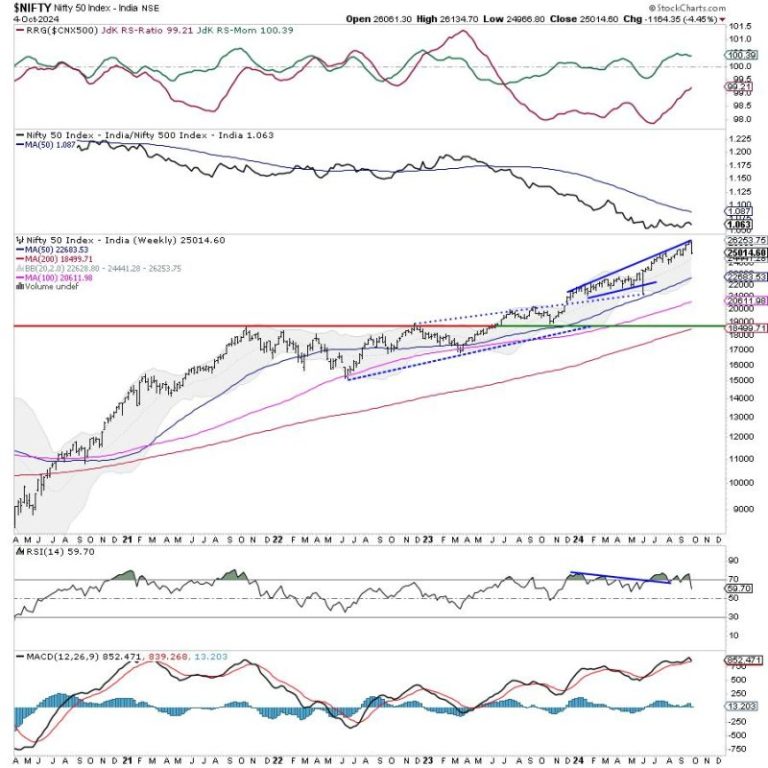

When analyzing the Nifty, it is essential to consider various technical indicators and chart patterns to identify potential trends and support/resistance levels. Technical analysis can help traders anticipate market movements and make informed trading decisions based on historical price data and market trends.

Furthermore, it is crucial to pay attention to major economic events and corporate announcements that can impact the Nifty and individual stocks. Events such as monetary policy decisions, GDP data releases, earnings reports, and geopolitical developments can significantly influence market sentiment and drive price movements.

In addition to technical analysis and fundamental factors, market sentiment plays a crucial role in determining the direction of the Nifty. Trader sentiment can be influenced by a variety of factors, including investor confidence, market news, and external events. By monitoring sentiment indicators such as the VIX (Volatility Index) and put/call ratios, traders can gauge the level of fear and greed in the market and make informed decisions accordingly.

Risk management is another critical aspect of successful trading and investing. By setting stop-loss orders, managing position sizes, and diversifying portfolios, traders can protect themselves from unexpected market moves and mitigate potential losses. It is essential to have a disciplined approach to risk management and stick to a well-defined trading plan to achieve long-term success in the market.

In conclusion, analyzing market moves, especially in indices like the Nifty, requires a combination of technical analysis, fundamental research, and an understanding of market sentiment. By staying informed, adopting a disciplined approach to trading, and managing risk effectively, traders and investors can navigate the complexities of the market and capitalize on profitable opportunities. Remember, successful trading is not just about predicting market moves but also about managing risks and making informed decisions based on a comprehensive analysis of the market.