The potential for a rally in the USD has been a topic of interest within the financial markets, with many analysts closely monitoring various indicators to gauge the currency’s future trajectory.

Technical analysis plays a significant role in predicting currency movements, and key indicators such as moving averages, support and resistance levels, and chart patterns are frequently used to assess potential trends. The USD, being a major global currency, is subject to various external factors that can influence its value. Geopolitical events, economic data releases, and central bank policies all play a part in determining the USD’s strength or weakness.

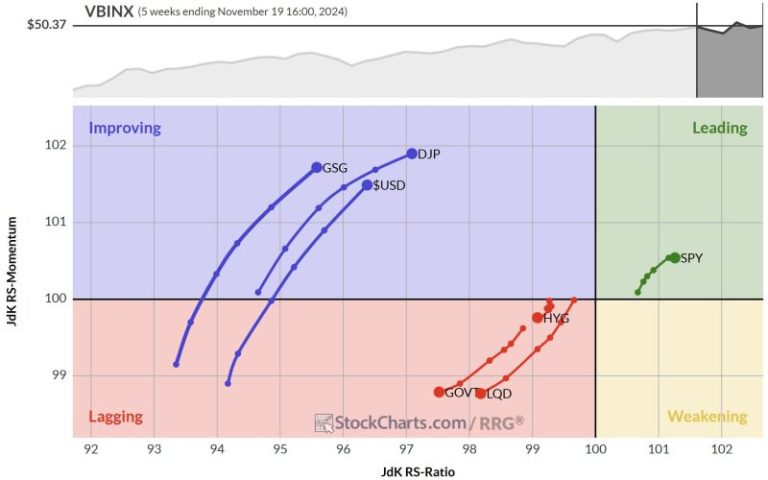

Recent data pointing to a potential rally in the USD has caught the attention of traders and investors. The USD has been in a consolidation phase for some time, with volatility relatively low compared to other periods. This consolidation phase has created a sense of anticipation among market participants, as they await a potential breakout in the currency.

One of the key drivers of a potential USD rally is the divergence in monetary policies between the US Federal Reserve and other central banks. The Federal Reserve’s hawkish stance towards interest rates and inflation is in contrast to the more dovish policies of other major central banks, creating a favorable environment for the USD to appreciate.

Furthermore, the USD’s safe-haven status during times of global uncertainty can also contribute to a rally in the currency. Events such as geopolitical tensions or economic instability in other regions can drive investors towards the safety of the USD, leading to an increase in demand for the currency.

In addition to external factors, technical analysis also supports the possibility of a USD rally. Chart patterns such as the formation of bullish trends and breakouts above key resistance levels can signal a change in the currency’s direction. Traders often look for confirmation from multiple indicators before entering into positions, increasing the likelihood of a sustained rally.

Despite the potential for a USD rally, it’s important to note that currency markets are inherently volatile and subject to sudden shifts in sentiment. Factors such as unexpected economic data releases or geopolitical events can quickly reverse trends, making it essential for traders to stay informed and adaptable in their strategies.

In conclusion, the USD’s potential for a rally is a topic of interest among investors and analysts, driven by a combination of technical analysis, fundamental factors, and market sentiment. While there are indications pointing towards a possible appreciation in the currency, it’s crucial for market participants to remain vigilant and prepared for any unexpected developments that could impact the USD’s trajectory.