Spot Ethereum ETFs had their 20th straight day of net inflows as of July 31, the longest streak of positive flows since their debut.

According to data from SoSoValue, these funds attracted a combined $17 million in net inflows on the day.

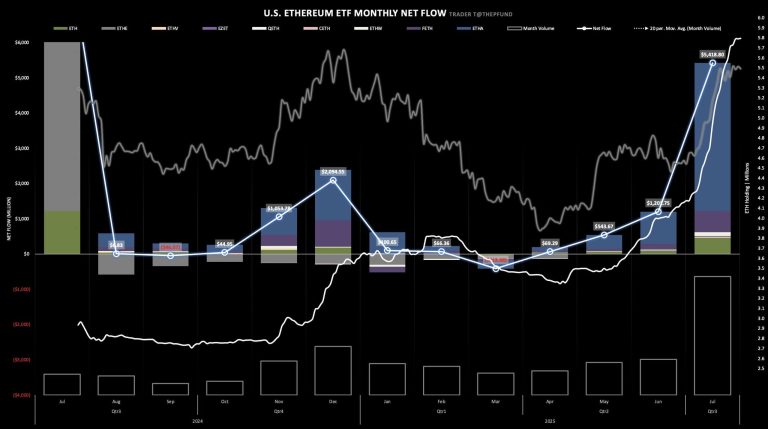

This sustained momentum has pushed total inflows across the nine spot ETH ETFs to nearly $5.4 billion, significantly higher than the cumulative flows seen in previous months.

In fact, this month’s inflows are approximately three times greater than the second-highest month since launch.

BlackRock’s spot ETH ETF, ETHA, led the charge with $4.2 billion in monthly inflows, accounting for 78% of all capital flowing into Ethereum ETFs.

Bloomberg ETF analyst Eric Balchunas highlighted the pace of growth, calling it “wild.” He noted that if Bitcoin ETFs didn’t exist, ETHA would be the fastest ETF in history to reach $10 billion in assets, beating previous records by nearly 2x.

These consistent gains have significantly boosted the total net assets under management. The spot Ethereum ETFs now hold $21.52 billion in net assets, representing 5% of Ethereum’s total market capitalization.

The post Ethereum ETFs sustain 20-day inflow streak, recording $5.4B in fresh capital in July appeared first on CryptoSlate.