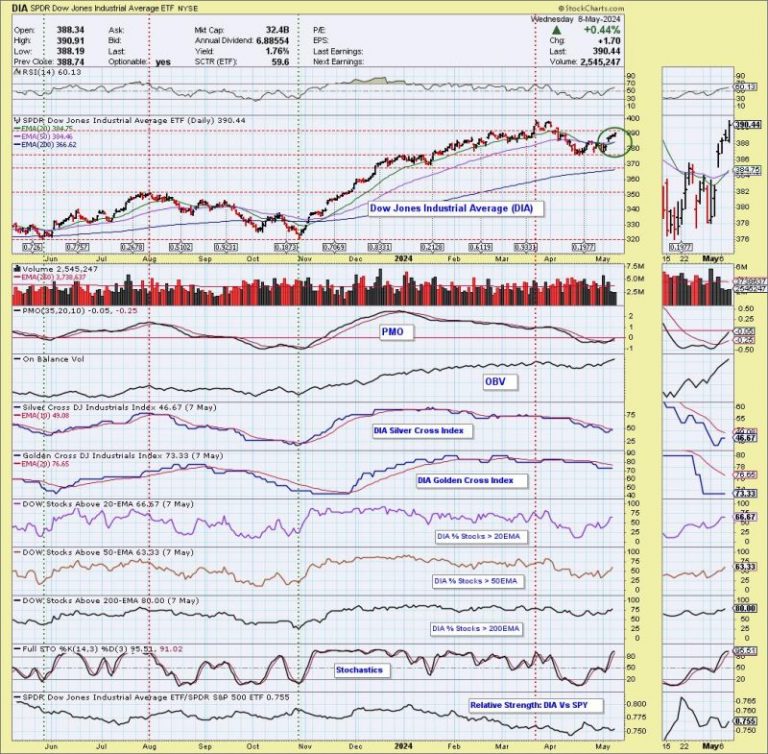

In a recent analysis by financial experts, the intricacies of silver cross buy signals on major market indices such as the Dow Jones Industrial Average (DIA) and the Russell 2000 (IWM) have been examined. The significance and potential implications of these signals cannot be understated, as they provide valuable insights into market trends and future movements.

The Dow Jones Industrial Average, a key benchmark index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange (NYSE) and the Nasdaq, has been a focal point of investor attention. The silver cross buy signal on the DIA indicates a potential upward trend in the market. This signal occurs when the short-term moving average crosses above the long-term moving average, suggesting increased buying momentum.

Similarly, the Russell 2000 index, which measures the performance of 2,000 small-cap companies in the Russell 3000 Index, has also shown a silver cross buy signal. This signal on the IWM is seen as a bullish indicator, signaling a potential rally in small-cap stocks. This could be attributed to improving economic conditions, favorable market sentiment, or other macroeconomic factors driving investor confidence.

The implications of these silver cross buy signals extend beyond just the indices themselves. Investors and traders often use these signals as a guide for their trading strategies, helping them make informed decisions on when to buy or sell assets. The presence of such signals can influence market sentiment, leading to increased trading activity and potentially impacting stock prices.

It is important to note that while silver cross buy signals can provide valuable insights, they are not foolproof indicators of market direction. Market trends are influenced by a myriad of factors, and it is essential to consider a holistic view of the market landscape before making investment decisions solely based on technical signals.

In conclusion, the emergence of silver cross buy signals on the Dow Jones Industrial Average and the Russell 2000 index highlights the potential for upward momentum in the market. Investors and traders should carefully evaluate these signals in conjunction with other market indicators to make informed investment choices. As always, diversification, risk management, and a deep understanding of market dynamics are key components of successful investing in today’s ever-changing financial landscape.