The Federal Reserve: A Puppeteer’s Nightmare

As the cornerstone of the US monetary system, the Federal Reserve plays a pivotal role in shaping economic conditions within the country. However, recent events have raised concerns about the Fed’s impact on the financial markets and the broader economy. The Fed’s decision-making processes and policies are now under intense scrutiny, with critics arguing that the central bank may be inadvertently creating a nightmare scenario for itself and the American public.

One of the key issues facing the Fed is its unconventional monetary policy measures, such as quantitative easing and near-zero interest rates. While these policies were initially intended to stimulate economic growth and combat deflation during the 2008 financial crisis, they have since become a staple of the Fed’s toolkit. Critics argue that these measures have distorted market signals, incentivized excessive risk-taking, and fueled asset bubbles in various sectors, including housing and stocks.

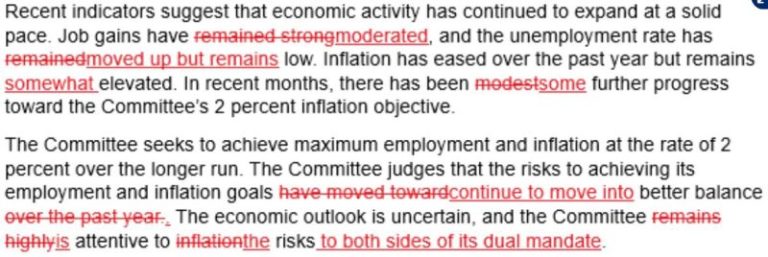

Moreover, the Fed’s communication strategies have come under fire for their inconsistency and ambiguity. Market participants often struggle to decode the central bank’s signals, leading to heightened volatility and uncertainty. The Fed’s recent pivot from a hawkish to a dovish stance has further fueled speculation about its ability to effectively manage market expectations and stabilize the economy.

Another contentious issue is the Fed’s independence or lack thereof. Critics allege that the central bank is subject to political pressure and influence, undermining its credibility and autonomy. The recent clash between former President Trump and Fed Chair Jerome Powell over interest rate policy highlights the delicate balance between central bank independence and political accountability.

Furthermore, the Fed’s role as a lender of last resort has raised concerns about moral hazard and systemic risk. The central bank’s interventions to rescue failing financial institutions and support corporate debt markets have led to accusations of corporate welfare and market distortion. Critics argue that the Fed’s actions are propping up zombie companies and delaying the necessary process of creative destruction in the economy.

In conclusion, the Federal Reserve finds itself at a crossroads, grappling with a series of challenges that threaten to undermine its effectiveness and legitimacy. As the central bank navigates the complexities of a post-pandemic world, it must carefully consider the unintended consequences of its policies and actions. Transparency, accountability, and a steadfast commitment to its mandate are essential for the Fed to regain public trust and fulfill its mandate of promoting price stability and full employment. Failure to address these issues could potentially lead to a nightmare scenario where the Fed loses control of the very forces it seeks to manage.