The article begins by analyzing a breadth indicator that suggests the potential for further downside in the market. The author points out that the indicator has been historically accurate in signaling market weakness and potential downturns. This insight serves as a warning to investors to exercise caution and consider the possibility of increased volatility and negative price movements.

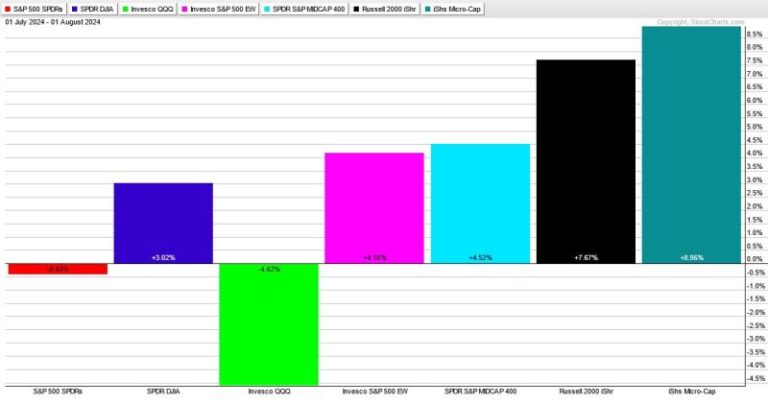

The article then delves into the technical details of the indicator, explaining how it calculates the breadth of the market by assessing the performance of individual stocks and sectors. By examining the underlying components of the market, the indicator provides a more comprehensive view of market health beyond just the headline indices.

The author emphasizes the importance of monitoring breadth indicators alongside other technical and fundamental analyses to get a well-rounded view of market conditions. While market breadth indicators can provide valuable insights, they should not be used in isolation but rather as part of a broader analysis framework.

Moreover, the article highlights the potential opportunity that may arise from a market downturn. While downturns can be concerning for investors, they also present a chance to buy assets at a discounted price. Savvy investors who have done their homework and identified strong investment opportunities can capitalize on market weakness to build positions for the long term.

In conclusion, the article stresses the importance of staying vigilant and informed about market breadth indicators and other relevant metrics. By being proactive in monitoring market conditions and understanding the potential opportunities they present, investors can navigate volatile markets more effectively and position themselves for long-term success.